Market Overview

- Market sentiment: neutral.

- Major indices or crypto trends: Bitcoin dominance. ETH to BTC continues to decrease.

- News highlights: Nothing to be mentioned.

Screening Results

- Coins in focus: MKR, 1000SATS, MELANIA

- Criteria for selection:

- High trader’s interest

- High market volumes

- Density within order books

Trade Ideas

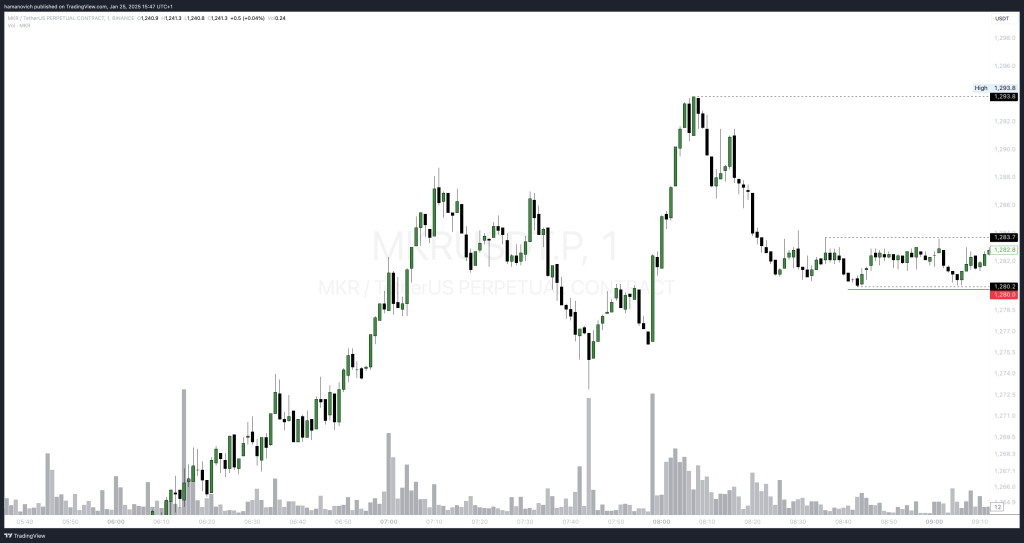

1. MKR/USDT

- Reason for selection: Huge density on a round level 1280,0.

- Timeframe: 1 to 5mins.

- Key levels:

- Entry: 1281

- Stop-loss: 1280

- Take-profit: 1300

- Risk/Reward: 1/15.

Executed Trades

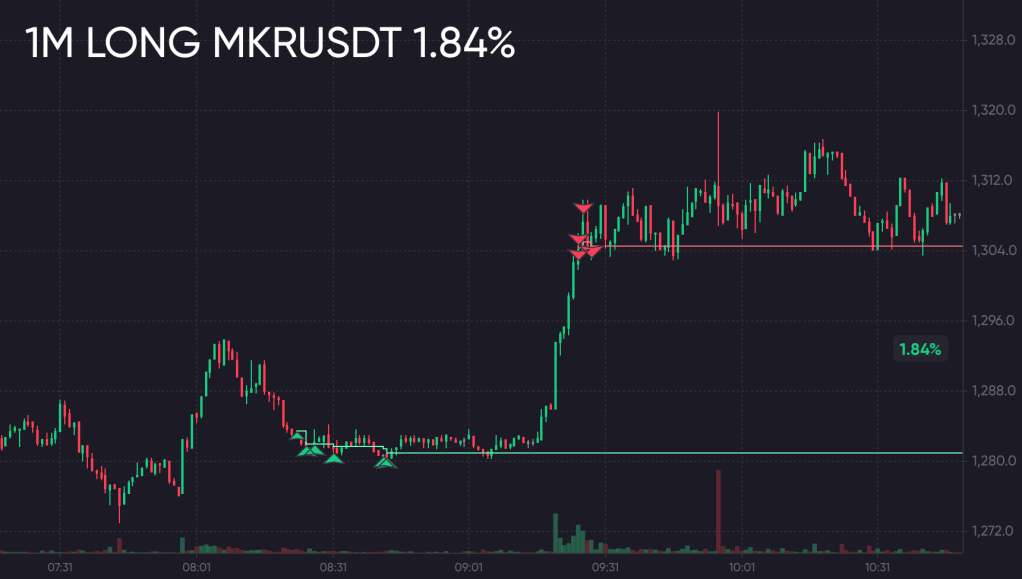

1. MKR/USDT

The first try, in the morning.

Summary of trades placed:

- Entry price: 1280,97. Exit: 1304,59.

- After a few minutes of consolidation, the price increased rapidly to the value of 1310 and began to slow down. I decided to exit without waiting for a pullback.

Later evening, after the second approach, the density was quickly broken up.

- Summary of trades placed:

- Despite the fact that the density remained, from the second time sellers were able to sell the price down quickly.

- Lessons learned:

- Large densities at round values can be traded off.

- In case of decreasing density – exit without waiting for its complete dismantling.

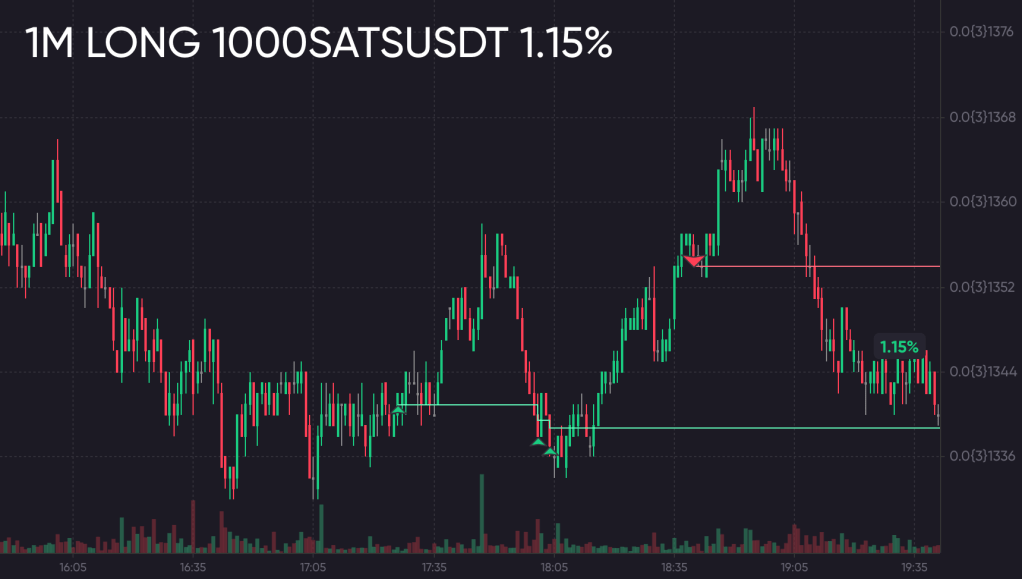

2. 1000SATS/USDT

- Summary of trades placed:

- I saw a large density in the order book and entered from it. The price increased quickly, but after making a pullback to the entry point, I added 2 more orders to the position and after the next wave of growth, fixed 1.15% profit.

In 2 hours I decided to repeat the trade, but at this time the density was instantly eaten. Position was closed by stop-loss of 0,5%. And the price continued on its downward trajectory.

Conclusion

From large densities, trading from large densities can and should be done. However, it is very important to make sure that this density is not quickly dismantled, otherwise a breakout will occur.

Leave a comment